Select Language:

Asia: The World’s Largest Oil Importer

The Rising Influence of Asian Countries in the Global Oil Market

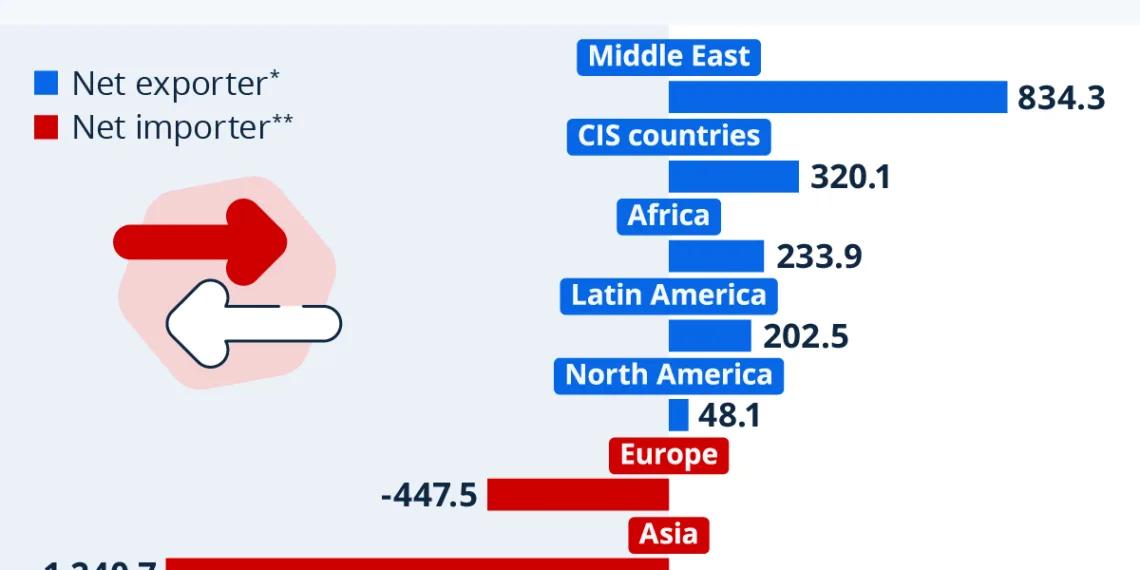

As global demands for energy continue to evolve, Asia has established itself as the world’s preeminent oil importer. With a staggering net import figure of over 1.2 billion tonnes in 2023, Asian economies, particularly giants like China and India, have positioned themselves as pivotal players in the international oil landscape. This shift comes against a backdrop of geopolitical tensions, particularly the ongoing Russia-Ukraine war, which has further complicated the dynamics of oil trading on a global scale.

Neutrality Amidst Geopolitical Tensions

Despite the turbulent atmosphere surrounding the Russia-Ukraine war, many Asian countries have publicly adopted a neutral stance. This nuanced position allows them to navigate the complex interplay of international relations while securing vital energy resources. Notably, China and India have continued to engage with Russian oil suppliers, often exceeding price caps established by Western nations. This has not only proliferated critical funds to Russia but also ensured that these countries maintain their energy needs in a time of high volatility.

Sanctions and Their Implications

The imposition of sanctions by Western countries and the G7 in late 2022 created significant friction in the oil trade. These sanctions specifically targeted Russian use of shipping infrastructure, a sector heavily relied upon for global oil transport. As part of these regulations, a price cap of $60 per barrel was placed on Russian crude oil, severely restricting Russia’s ability to utilize Western maritime services.

Western nations have focused on curtailing the flow of funds to Russia by limiting the financial and logistical support that is available for its oil exports. Sanctioning services such as vessel chartering, brokerage, and financial assistance is a central component of this strategy, aimed at minimizing Russia’s oil revenue.

The Emergence of Russia’s Shadow Fleet

In response to these imposing sanctions, Russia has initiated what has been termed a "shadow fleet." This operational strategy involves utilizing a fleet of tankers with obscure ownership and insurance structures, making it difficult for Western authorities to trace back to Russian ownership. By doing so, Russia seeks to bypass sanctions while still delivering oil to its customers, many of whom are situated in Asia.

However, reports indicate that many of these vessels have been sanctioned by the United States, the EU, and the UK, rendering them unable to freely operate in global waters. With new vessel-specific sanctions coming into effect, experts predict that these measures may significantly impact Russia’s fossil fuel revenues sourced from Asian markets.

Changing Dynamics of Asian Oil Trade

As Asia’s oil demands remain steadfast, the recent geopolitical events have led to a recalibration in the region’s oil trade strategies. While traditional buyers in Asia have historically embraced opportunities to procure cheaper oil from Russia, the growing complexity around sanctions has prompted these nations to draw a line in the sand. As such, Asian countries are beginning to turn away from vessels implicated in sanction violations, signaling a shift in their procurement practices.

This transformation in the oil market underscores Asia’s significance not only as a consumer but also as a potentially stabilizing force in energy trading. By recalibrating their purchasing behaviors, Asian nations are demonstrating a newfound agency in the face of international crises, establishing themselves as central actors in the global economy.

Asia’s Oil Trade vs. Other Regions

In the broader context of global oil trading, Asia’s status as the largest oil importer becomes even more pronounced. In stark contrast, Europe has been grappling with its own negative oil trade balance, standing at approximately 450 million tonnes. Meanwhile, other regions of the world remain predominantly net exporters of crude oil. This paints a clear picture of the shifting dynamics in global energy markets where Asia’s consumption patterns are leading the way, driven by economic growth and energy security needs.

In summary, as Asia continues to navigate the complexities of international oil trading amidst sanctions and geopolitical shifts, its influence on the global stage only stands to grow. The region’s ability to balance neutrality while fortifying its energy supplies will be instrumental in shaping the future landscape of the oil market.