Select Language:

AI-Powered Tech Boom Fuels 2024 Stock Market Rally

Introduction to the Stock Market Landscape in 2024

The U.S. stock market has reached impressive heights in 2024, showcasing resilience and growth despite prevailing economic uncertainties and political challenges. With persistent inflation affecting consumer sentiment, many might find it surprising to see the market thriving. However, a closer analysis reveals that a select group of tech giants—dubbed the "Magnificent Seven"—has played a pivotal role in this surge.

The Magnificent Seven: Key Players Driving the Rally

Overview of the Magnificent Seven

The "Magnificent Seven" refers to seven of the largest and most influential tech companies, including Apple, Amazon, Microsoft, Meta, Alphabet, Tesla, and Nvidia. Collectively, these powerhouses have significantly influenced market movements, accounting for more than half of the total return of the S&P 500 index in 2024.

Performance Highlights

Nvidia, in particular, highlighted the tech boom with a staggering 171 percent increase in its share price. This remarkable performance alone contributed over 20 percent to the overall return of the market-cap-weighted index for the year, underscoring the transformative impact of AI advancements on its business model and stock performance.

Sector Contributions to the S&P 500’s Return

Dominance of Technology and Communication Services

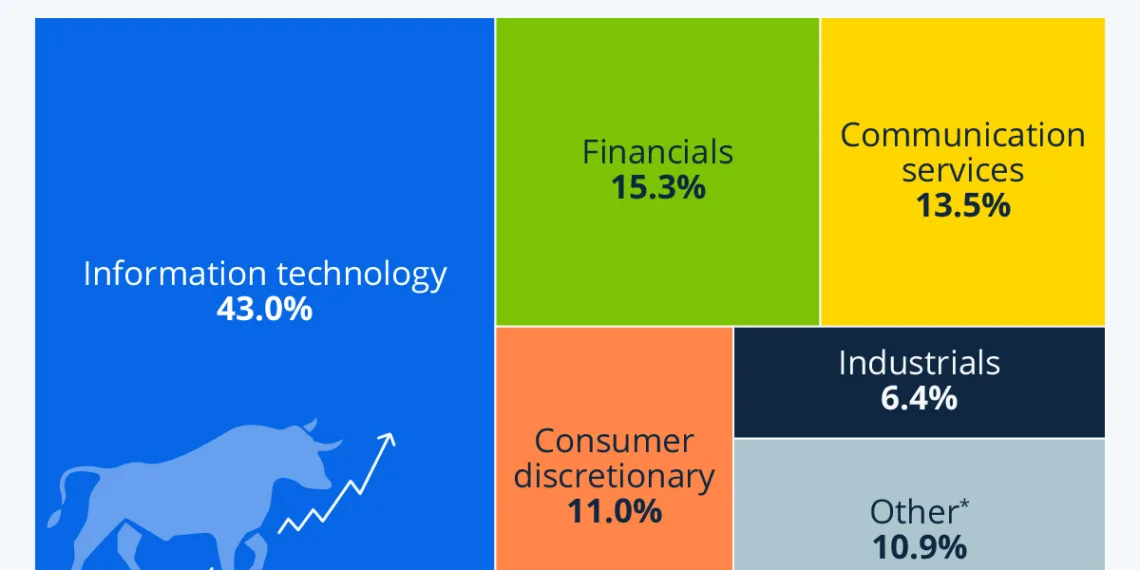

According to Howard Silverblatt, a senior index analyst at S&P Dow Jones Indices, the information technology and communication services sectors emerged as the stalwarts of the S&P 500’s performance. Together, these sectors were responsible for a substantial 56.5 percent of the index’s total return of 25 percent in 2024. The importance of these sectors cannot be overstated—without them, the S&P 500 would have only realized an 11 percent return.

Insights into Other Contributing Sectors

While tech took the spotlight, other sectors also made noteworthy contributions. The financial sector added about 15 percent to the total return of the S&P 500, reflecting stability and growth within financial institutions, which may have adapted successfully to changing economic conditions.

The consumer discretionary sector, which often takes a backseat in challenging economic times, accounted for an 11 percent contribution to the index. This surprisingly strong performance can be attributed largely to the presence of mega-cap companies like Amazon and Tesla. With share prices soaring by 44 percent and 63 percent, respectively, these giants were instrumental in driving the overall performance of the consumer discretionary sector.

Understanding Economic Context and Impact

Navigating High Inflation and Economic Discontent

Despite high inflation rates and widespread economic discontent, consumer spending did not falter in the tech-dominated market. This is noteworthy, as soaring prices usually lead consumers to curtail non-essential purchases. However, the ongoing digitization and AI investment cycle has kept consumers engaged with these tech giants.

AI Investment Cycle’s Role in Stock Performance

One of the fundamental catalysts behind the stock market rally is the ongoing investment cycle centered around artificial intelligence (AI). Companies that have successfully integrated AI into their operations or products—like Nvidia—have reaped significant rewards, showcasing the growing importance of technology in modern business practices.

Conclusion of Insights

Overall, the 2024 market dynamics present an interesting tableau where a combination of technology prowess and strategic performance in a somewhat constrained economic environment has shaped the stock market landscape. Investors are increasingly attentive to how innovations, particularly in AI, continue to influence market trajectories amid potential challenges ahead.