Select Language:

Understanding Credit Card Ownership Around the World

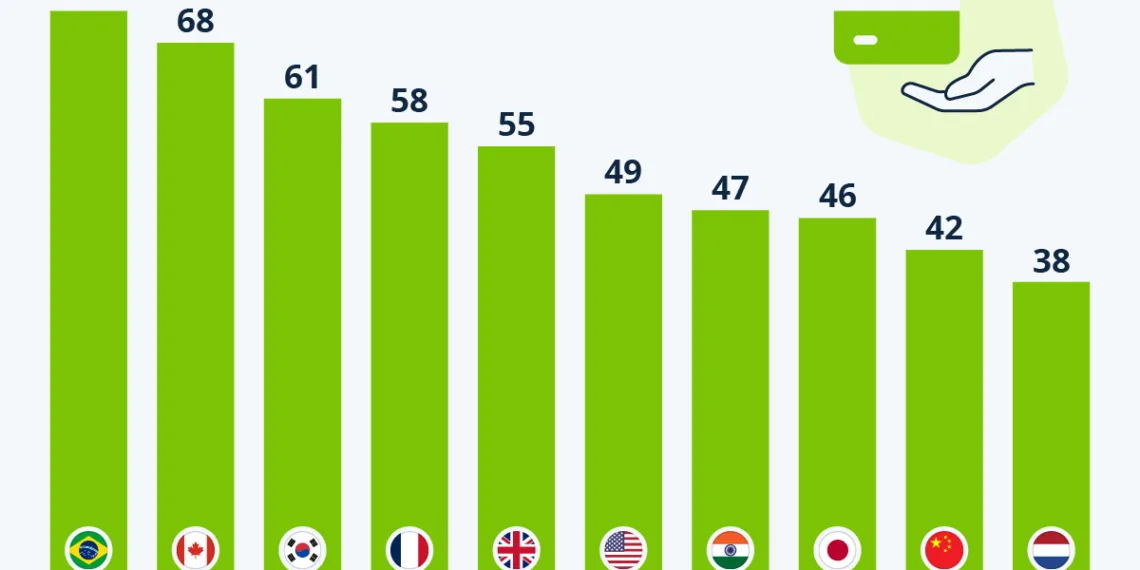

Credit cards play a significant role in financial transactions globally. From their convenience to the various benefits they offer, these cards have become an essential part of modern consumer culture. Recent data illustrates the widespread usage of credit cards in different countries, providing insight into consumer behavior and financial practices.

Credit Card Usage in Brazil

In Brazil, credit card ownership is prevalent, with a remarkable 72% of online respondents aged between 18 and 64 years boasting credit cards as of 2024. A unique feature of Brazilian credit cards is their dual functionality; they often work as both debit and credit cards. This flexibility allows consumers to manage their finances more effectively while still enjoying the benefits associated with credit.

Moreover, many Brazilian credit cards have the option to pay in installments, making them especially appealing for larger purchases. This practice of installment payments has become a standard approach to shopping in the country, enabling consumers to make significant purchases while distributing the costs over time.

Credit Card Penetration in Canada

Canada stands out in the global landscape of credit card ownership, with about 68% of Canadians carrying a credit card. The popularity of credit cards in Canada can be attributed to various factors, including attractive rewards programs. Many Canadians see credit cards not merely as a payment tool but as a means of earning rewards on their everyday purchases.

Canada is often cited as having one of the highest credit card penetration rates worldwide, with a notable occurrence of individuals owning more than one card. This dual ownership trend highlights a shift in consumer behavior, as many Canadians prefer credit cards over debit cards, showcasing a cultural inclination towards credit-based transactions.

Credit Card Landscape in the United States

In the United States, credit card usage has seen varying statistics, with approximately 49% of respondents stating they own a card. This figure indicates that while credit card usage is common, there remains a significant portion of the population that may rely on alternative payment methods.

The U.S. credit market is characterized by fierce competition among credit card companies, offering various incentives such as cash back, travel points, and even introductory offers for new cardholders. These incentives are designed to attract new customers and encourage current cardholders to utilize their cards more frequently.

Credit Card Ownership in China and the Netherlands

Credit card usage in China is relatively lower compared to Brazil and Canada, with 42% of respondents indicating ownership. The Chinese market tends to favor mobile payment solutions and digital wallets, which are increasingly integrated into everyday transactions. This shift has influenced the traditional usage of credit cards, leading to a distinct payment culture that prioritizes convenience and technological integration.

Conversely, the Netherlands exhibits the lowest credit card ownership in the surveyed nations, with only 38% of respondents owning a credit card. The Dutch population often prefers debit cards and other payment methods, reflective of the country’s strong banking infrastructure and consumer habits that emphasize financial prudence.

Summary of Global Credit Card Trends

The data surrounding credit card ownership reveals significant trends in consumer behavior across different countries. From Brazil’s hybrid card system to Canada’s reward-centric utilization and the mobile-first approach in China, each country has developed its own relationship with credit cards. Understanding these dynamics is crucial for businesses aiming to tap into the growing market of credit card users and for consumers looking to navigate their financial options effectively.

As the financial landscape continues to evolve, the role of credit cards will likely become even more integrated into global commerce, influencing how people manage spending and savings in the future.