Select Language:

The Growing Significance of Remittances in the Global Economy

Remittances have become a vital source of income for many low- and middle-income countries, playing a crucial role in their economic development and stability. Recent data from the World Bank highlights the upward trend in remittance inflows, showcasing their increasing importance in the global economic landscape.

Overview of Remittance Inflows in 2024

In 2024, remittance inflows to low- and middle-income countries reached a staggering $685 billion, a notable increase from $647 billion in the previous year. This growth trend reflects a wider global increase in remittances, which totaled an impressive $905 billion. These figures underscore the critical financial lifeline that remittances provide to millions of families around the world, bolstering household incomes and contributing to national economies.

Top Recipients of Remittances

Major Players

India continues to dominate the remittance landscape, receiving $129 billion in 2024, followed by Mexico at $68 billion and China at $48 billion. These countries represent the largest recipients of remittances, benefiting significantly from the financial support sent home by their diaspora abroad.

Economic Impact on Smaller Economies

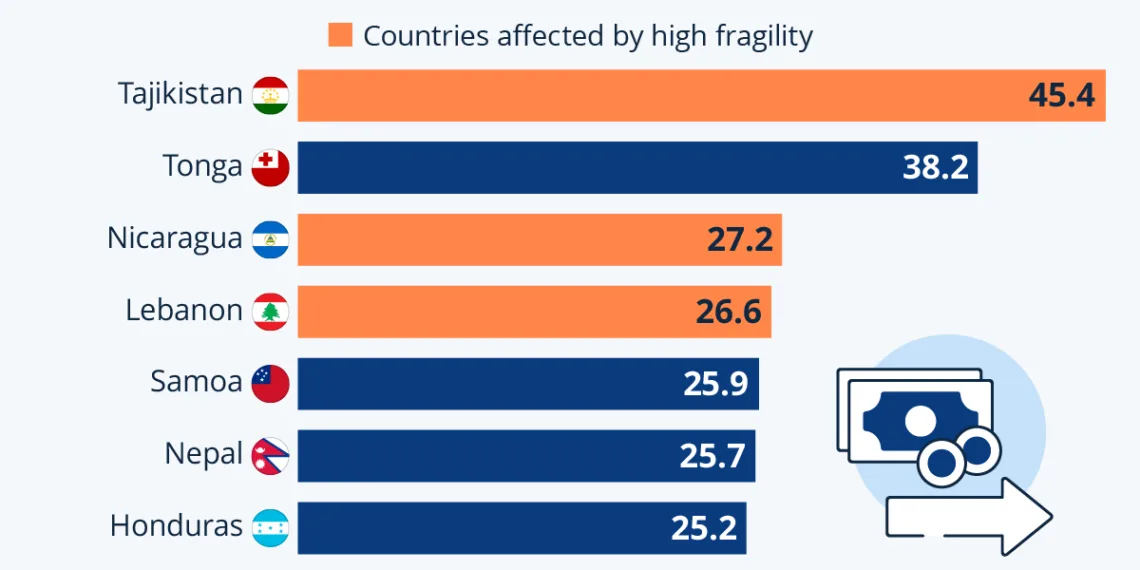

While the absolute figures are noteworthy, the real story lies in how remittances impact smaller and poorer economies. For many of these nations, remittances constitute a substantial portion of their GDP, illustrating their dependence on these funds. For instance, Tajikistan stands out as a prime example, with remittances accounting for a staggering 45.4 percent of its GDP in 2024. This dependency is often linked to the increasing demand for migrant workers in Russia, which has become a key destination for Tajik labor.

Remittances and Fragility in Economies

The Fragility Context

An analysis from the OECD reveals a troubling intersection between remittance dependence and economic fragility. Among the top contexts where remittances constitute the largest share of GDP, three out of four were categorized as highly fragile nations. This suggests that reliance on remittances can often coincide with underlying socio-economic vulnerabilities, where external financial support becomes crucial for survival.

Case Studies

Nicaragua, for instance, has experienced substantial remittance inflows, amounting to 27.2 percent of its GDP. The driving forces behind this trend include prolonged economic and political instability, which has prompted many Nicaraguans to migrate, predominantly towards the United States. Meanwhile, Honduras, previously recognized for its high fragility, has seen changes in its classification but remains a significant context of remittance dependence.

The OECD’s Findings

The OECD’s research identified 14 out of 61 highly or extremely fragile contexts in 2023 where remittances constituted over 10 percent of GDP. This finding highlights the critical nature of remittances in sustaining economies that are vulnerable to various forms of instability.

Conclusion

As remittances continue to grow in significance for developing economies, understanding their implications on both a macroeconomic scale and individual livelihoods is essential. The dependence on remittances raises important questions about the resilience and sustainability of these economies in the face of global economic shifts and local challenges. The evolving dynamics will be crucial in shaping policies that leverage the potential of remittances while addressing the fragility they often accompany.