Select Language:

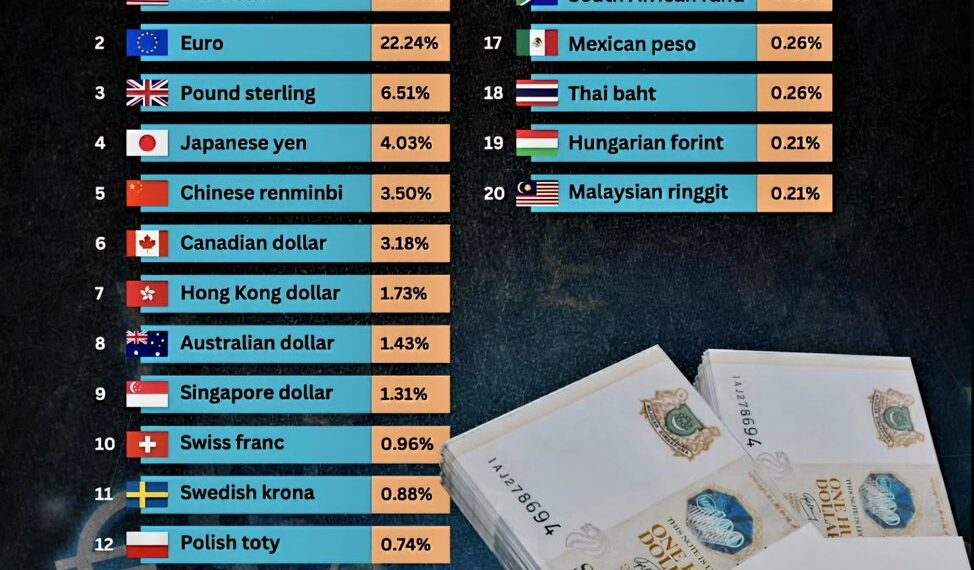

20 Most Influential Currencies in the World (2025)

In today’s global economy, currency plays a pivotal role in international trade, investment, and financial stability. As we look towards 2025, a recent analysis has revealed the 20 most influential currencies across the globe. These currencies not only facilitate transactions but also reflect the economic strength and international standing of their respective countries. Here’s a closer look at these currencies shaping financial markets.

U.S. Dollar – 49.68%

Dominating the currency landscape, the U.S. dollar remains the world’s primary reserve currency, accounting for nearly 50% of international transactions. Its widespread acceptance fosters confidence and stability, making it the go-to currency for global trade and investment.

Euro – 22.24%

As the second most influential currency, the euro is the official currency of 19 of the 27 European Union countries. It benefits from a robust economy and strong collective backing, making it a favored choice for trade within Europe and beyond.

Pound Sterling – 6.51%

The British pound continues to hold sway in global finance despite recent economic fluctuations. Its historical significance and stability reinforce its position as a top currency in international dealings.

Japanese Yen – 4.03%

Japan’s yen is synonymous with liquidity and is often sought after during market turbulence. Its strength reflects Japan’s significant role in technological innovation and manufacturing.

Chinese Renminbi – 3.50%

The Chinese renminbi has rapidly risen in prominence, thanks in large part to China’s growing economic might. Increasingly, global businesses are embracing the renminbi for trade, boosting its international reputation.

Canadian Dollar – 3.18%

The Canadian dollar stands out for its relative stability and connection to abundant natural resources. As trade relations with the U.S. strengthen, its global significance grows.

Hong Kong Dollar – 1.73%

Hong Kong’s unique positioning as a financial hub in Asia has cemented the Hong Kong dollar’s status. Its link to the U.S. dollar and vibrant trade sector enhances its global reach.

Australian Dollar – 1.43%

The Australian dollar benefits from the country’s strong export economy, particularly in commodities. Its attractiveness as a trade currency makes it a favorable option for international investors.

Singapore Dollar – 1.31%

Singapore’s dollar is bolstered by the nation’s robust financial services sector. With a reputation for stability, the Singapore dollar attracts many foreign investments.

Swiss Franc – 0.96%

Known for its reliability, the Swiss franc often serves as a safe haven during economic uncertainty. Switzerland’s strong banking system and political neutrality contribute to its global standing.

Swedish Krona – 0.88%

The Swedish krona benefits from Sweden’s innovative economy and solid export market. Its stability and integration within the EU enhance its international appeal.

Polish Zloty – 0.74%

Increasingly included in global transactions, the Polish zloty signifies Poland’s growing economic presence in Europe and beyond.

Norwegian Krone – 0.39%

With a strong economy driven by natural resources, the Norwegian krone stands out as a currency of choice for those engaged in energy markets.

Danish Krone – 0.39%

The Danish krone reflects Denmark’s stable economy and strong financial sector, positioning it as a reliable currency for international transactions.

New Zealand Dollar – 0.33%

Often viewed as a commodity currency, the New Zealand dollar capitalizes on the country’s agricultural exports, ensuring its significant role on the global stage.

South African Rand – 0.26%

The South African rand remains central in African trade, reflecting the country’s economic diversity, particularly in mining and agriculture.

Mexican Peso – 0.26%

The Mexican peso has become increasingly integral to North American trade, benefiting from strong economic ties with both the U.S. and Canada.

Thai Baht – 0.26%

With Thailand’s robust tourism sector and developing economy, the Thai baht is gaining traction as an influential currency in Southeast Asia.

Hungarian Forint – 0.21%

The Hungarian forint, while smaller in influence, represents the central and eastern European economic landscape poised for growth.

Malaysian Ringgit – 0.21%

The Malaysian ringgit reflects the growing significance of Southeast Asia’s economy, driven by trade and manufacturing.

In summary, these 20 currencies are instrumental in molding the financial landscape as we head into 2025. Their influence reflects not only economic strength but also the interconnected nature of global markets. Understanding these currencies is essential for anyone looking to navigate the complexities of the international economy.