Select Language:

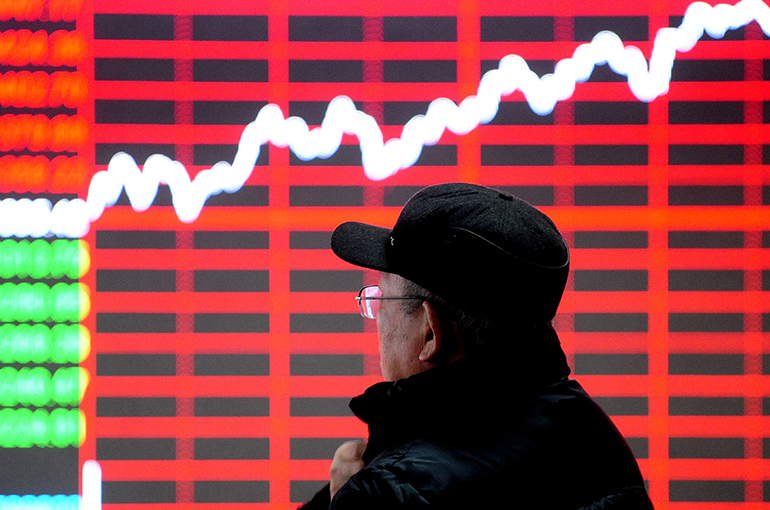

The Shanghai Stock Exchange Composite Index, which serves as China’s primary benchmark for listed companies, has been oscillating around the 4,100 mark since late January. Despite this, major Wall Street investment firms remain optimistic about the market’s future, citing improving liquidity and growing investor confidence.

This optimism is driven by increased foreign investments and a rebound in individual investor activity since last month. These trends could help reduce selling pressure from government-backed funds via exchange-traded funds and foster a more favorable liquidity environment, according to a recent analysis.

Estimates show that net investments from mutual funds registered in the U.S. and Europe into China’s stock market totaled approximately $8.6 billion last month — the highest since October 2024. During the same period, the number of new A-share accounts and small-scale investments (transactions below CNY 40,000 or about $5,760) both reached their highest levels since 2025.

Major financial firms like Goldman Sachs, Fidelity International, and Invesco have also expressed positive outlooks for the market.

The widespread recognition of “Chinese innovation,” along with strong interest in artificial intelligence and robotics, is expected to keep market sentiment robust throughout 2026, according to Fan Xiang, co-head of investment banking at a leading Chinese financial institution.

Fidelity highlighted that China’s market has become more resilient with valuations that appear attractive compared to other global markets. The market’s vitality is returning, with capital flow momentum strengthening for both A-shares and offshore China-related stocks. This is driven by policies that support consumer spending, stabilize the real estate sector, and promote structural reforms, explained Stuart Rumble, Fidelity’s investment director for the Asia-Pacific region.

While risks such as a sluggish real estate recovery and geopolitical uncertainties persist, more stable policies and clearer visibility into corporate earnings are expected to attract more domestic and international investors, Rumble added.

Fundamentals are steadily improving, and long-term growth factors are underpinning a more sustainable growth cycle for the A-share market, noted Raymond Ma, CIO for China’s mainland and Hong Kong at Invesco.

He pointed out that corporate profits are signaling a clear recovery, with earnings per share expected to rise further. Gains in operational efficiency and enhanced leverage have boosted profit margins, laying a stronger foundation for sustained profitability.

Ma also indicated that this year’s primary investment opportunities in China likely include industrial upgrading, advancements in artificial intelligence, and improvements in the consumer market.