Select Language:

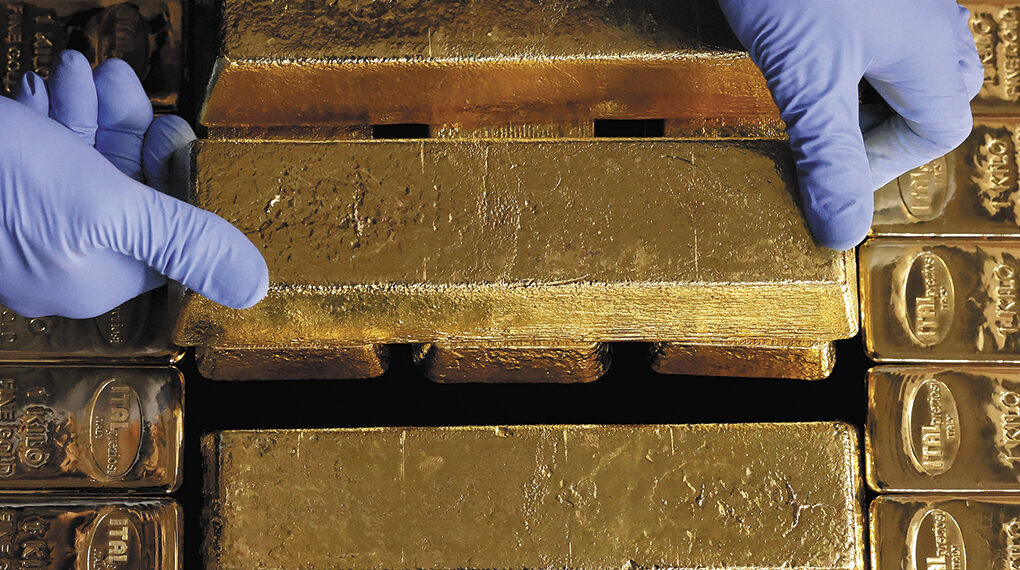

China has increased its gold reserves for the ninth consecutive month in July, despite a recent slight decline in the metal’s price from its all-time high. At the same time, the country’s foreign exchange reserves decreased due to the strengthening US dollar.

According to data released yesterday, the central bank added 60,000 ounces of gold in July, bringing total holdings to approximately 73.96 million ounces compared to June. In terms of value, this increase translates to roughly $1 billion, bringing the total reserve to around $244 billion.

Since November, China’s central bank has accumulated about 1.16 million ounces of gold.

Recently, the easing of international trade tensions has led to a decrease in demand for safe-haven assets, causing gold prices to stabilize at elevated levels, according to a chief macro analyst. The analyst mentioned that global political and economic uncertainties, especially following Donald Trump’s presidency, have made gold more attractive, and there’s no urgency for the central bank to halt its gold acquisitions.

Gold prices exceeded $3,500 per ounce on April 22 amid tensions stemming from US tariffs and have since fluctuated between $3,100 and $3,500. Currently, the price hovers around $3,400 per ounce.

Gold makes up about 7% of China’s official reserves, considerably less than the global average of 15%. To optimize reserve assets, the strategy is to increase gold holdings further and slightly reduce US bonds, the analyst stated.

By the end of last month, China’s foreign exchange reserves stood at around $3.3 trillion, down roughly $25.2 billion from June. This decline is primarily attributed to exchange rate movements and changes in asset prices, as noted by the foreign exchange authorities.

The US Dollar Index, which measures the dollar’s strength against a basket of other currencies, rose 3.4% in July, ending a five-month decline. This uptick came after improved trade agreements with multiple countries, leading to a relative depreciation of non-dollar assets within foreign reserves.