Select Language:

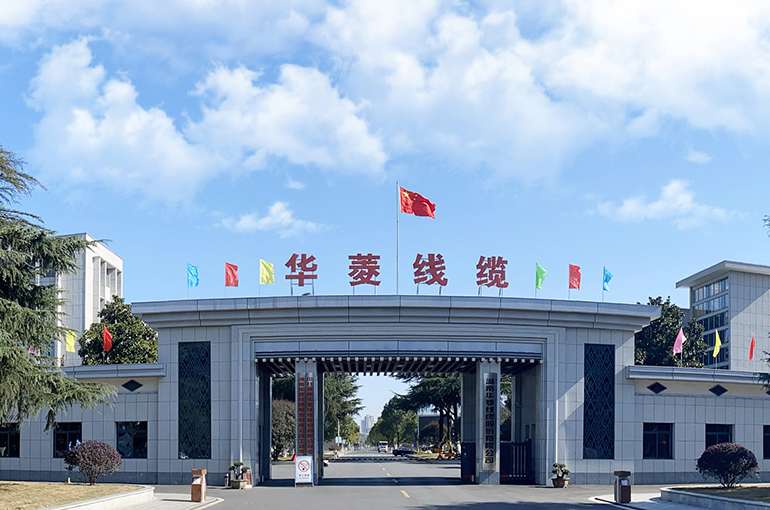

Shares of Valin Wire & Cable hit their daily trading limit after the Chinese supplier announced plans to acquire a controlling stake in a startup specializing in robotics connectors. The company aims to expand its supply chain to better serve customer needs.

Today, Valin Wire & Cable [SHE: 001208] closed up 10% at CNY14.65 (USD2.06) per share in Shenzhen.

The company has signed a letter of intent to acquire assets from the two individual shareholders of Sanzhu Intelligent Technology, a Hunan-based firm, through cash and other methods. The specific shareholding ratio will be determined later, but the valuation of the target company is set at CNY270 million (USD38 million).

Sanzhu Intelligent researches, develops, manufactures, and sells connectors and wire harnesses, primarily used in servo drives, robots, and industrial manipulators. It has established itself as a leading supplier of industrial connection products within its niche sector, serving clients such as Panasonic Holdings from Japan, as well as domestic automation and robotics companies including Inovance Group, Xindao Intelligent Equipment, Midea Industrial Technology, and Estun Automation.

Last year, Sanzhu Intelligent reported a net profit exceeding CNY25 million (USD3.5 million) on unaudited operating revenue of CNY209 million. As of December 31, its net assets were CNY94 million. The company’s shareholders have set profit targets between CNY71 million and CNY75 million for 2026 to 2028, with a guarantee to compensate the new shareholders if these goals are not met.

The connectors developed by Sanzhu Intelligent serve as critical interfaces in high-end applications, including industrial automation, robotics, and renewable energy sectors. The acquisition is expected to enable the company to strengthen its supply chain, better address customer demands for integrated products, and accelerate its entry into new markets such as robotics and high-frequency transmission, ultimately creating additional growth avenues.