Select Language:

Shares of Piesat Information Technology soared after the Chinese aerospace company announced a deal valued at 2.9 billion yuan (approximately $406.4 million) with Pakistan. This agreement nearly doubles the company’s total revenue from the previous year, signaling significant growth.

The company’s stock jumped 15.2% to 36.28 yuan (around $5.10) today, marking an almost 80% increase in value since the start of the year. The deal was signed yesterday during the second Pakistan-China B2B Investment Conference held in Beijing, according to an official statement.

Under the terms of the agreement, Piesat will help Pakistan develop an integrated satellite system designed for global real-time communication and remote sensing. The initial phase involves launching and operating 20 satellites, establishing a satellite manufacturing plant, and creating supporting software. The company will also offer technical support to enable Pakistan to develop its own capabilities in satellite manufacturing, operations, and applications.

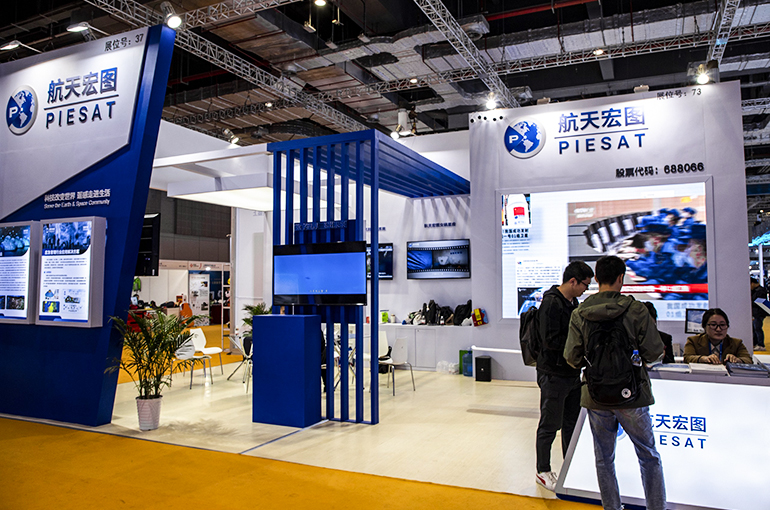

Founded in 2008, Piesat specializes in remote sensing and geospatial software, and it also manages a fleet of satellites. It listed on China’s Nasdaq-style Star Market in 2019 and recently relocated its headquarters from Beijing to Hebi, in central China.

Piesat is currently working on the Nuwa constellation, which aspires to be China’s largest commercial radar remote sensing satellite network, comprising 114 satellites. To date, 13 of these satellites have been launched, providing real-time data for disaster management, natural resource management, and environmental monitoring.

The company has faced challenges in recent years, mainly due to a sluggish macroeconomic environment and a decline in domestic orders. Last year, its net loss widened nearly four times to 1.4 billion yuan (about $196.2 million), with revenue decreasing 13% to 1.6 billion yuan.

In the first half of this year, its net loss grew by 34% year-over-year to 248 million yuan (roughly $34.8 million), while revenue plunged 66% to 290 million yuan, based on its latest financial report.