Select Language:

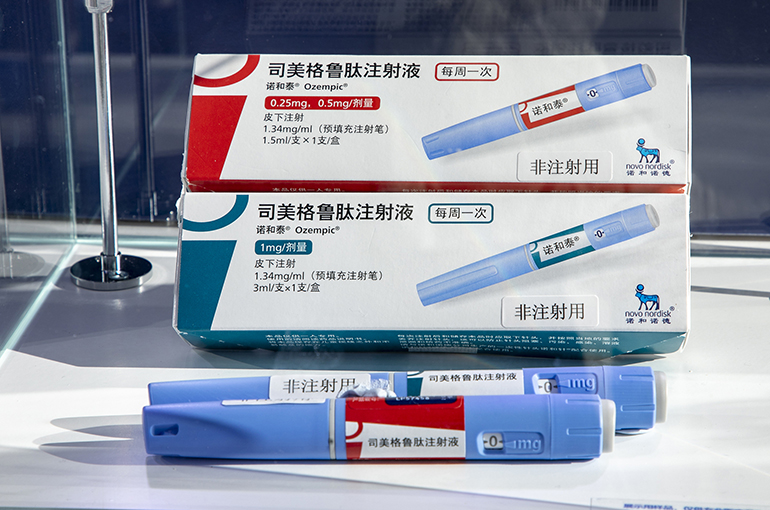

Novo Nordisk remains optimistic about its long-term prospects in the Chinese market despite experiencing a decline in local sales of its weight-loss medication during the first half of the year, according to its new CEO.

China presents significant unmet medical needs, said the CEO, who recently assumed leadership after previously managing global operations. During a recent earnings call, he emphasized the company’s commitment to strengthening its position in the world’s second-largest healthcare market.

Sales of Semaglutide, a drug that targets glucagon-like peptide-1 receptors, decreased by about 11 percent in China over the first six months, primarily due to inventory adjustments and timing issues rather than increased competition, he explained.

“We are very confident about China’s future because there’s a considerable amount of unmet demand,” he stated. “With 200 million people living with obesity and 100 million with diabetes, that gives me confidence.”

He also clarified that the company isn’t losing market share in China—in fact, it’s gaining it. The current lower growth isn’t due to competition, which remains minimal, but instead relates to inventory management and market timing.

“Last year, we built up significant stock in anticipation of launching Wegovy. Now, we need to adjust for that,” he said. “Additionally, we must accelerate growth in the GLP-1 market, particularly in diabetes and obesity care.”

While sales of Semaglutide in China declined, the company’s global obesity treatment sales surged 125 percent in the first half of the year, with Wegovy alone jumping 335 percent.

The company plans to expand beyond major Chinese cities into smaller markets, increasing investments in offline retail channels and digital platforms to reach more consumers.

“In the beginning, you start in urban centers and then move into broader regions—Tier Two, Tier Three, and Tier Four cities,” he explained.

For the second quarter, Novo Nordisk’s net profit increased 32 percent year-over-year to 26.5 billion Danish kroner (approximately $4.1 billion), though this was slightly below market expectations of 27 billion kroner. Revenue grew 13 percent to 76.9 billion kroner (around $12 billion), also below the anticipated 77 billion kroner.

Furthermore, the company has projected its annual sales growth to be between 8 and 14 percent, revised down from an earlier range of 13 to 21 percent, citing restrictions on Wegovy sales due to illegal drug compounding activities in the United States.