Select Language:

The stock price of MetaX Integrated Circuits, a Chinese manufacturer specializing in graphics processing units, skyrocketed nearly eight times on its debut on the Shanghai Stock Exchange’s Nasdaq-style Star Market.

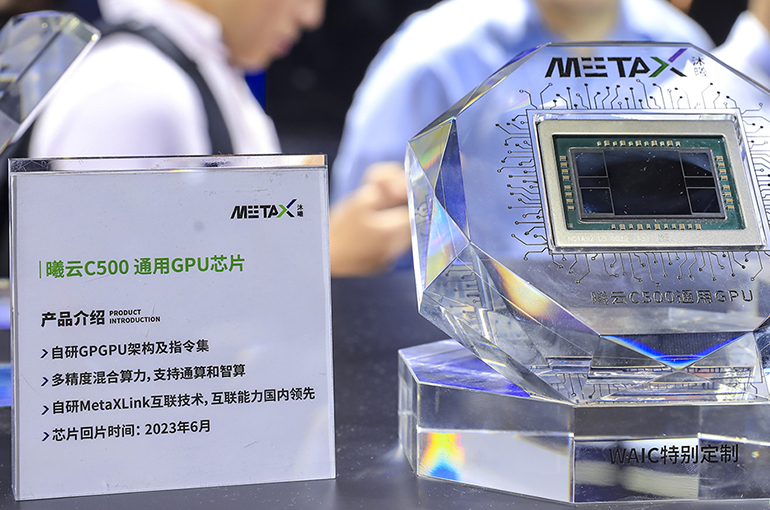

MetaX closed up 693% at CNY829.90 (USD117.80) today. For its initial public offering, MetaX issued 40.1 million shares at CNY104.66 (USD14.86) each, raising approximately CNY4.2 billion (USD596.2 million). These funds will support research and development of new high-performance, general-purpose GPUs, next-generation AI inference GPUs, and GPU technologies tailored for emerging applications.

Founded in Shanghai in 2020, the company has yet to turn a profit. However, its net loss narrowed by 56% to CNY345.5 million (USD49 million) during the first three quarters of the year compared to the previous year. Meanwhile, revenue soared 454%, reaching CNY1.2 billion.

The company attributes its ongoing lack of profitability to the long-standing dominance of foreign giants in the global GPU market, particularly Nvidia, which commands over 80% market share. Chinese firms entered the market later and are still in the early stages of technological breakthroughs and product deployment, requiring significant investments in R&D and market expansion.

Ongoing technological rivalry between China and the US, along with policies promoting domestic replacement, have driven up the market penetration of Chinese chips in recent years. This has led to the emergence of several competitive GPU manufacturers. However, the Chinese industry as a whole remains in its infancy, and a definitive competitive landscape has yet to solidify, according to company reports.

Another Chinese GPU maker, Moore Threads, went public on the same Nasdaq-style Star Market on December 5. Its stock surged more than fivefold upon debut after an IPO valued at CNY8 billion. As of today, the company’s shares [SHA: 688795] have increased 525%, reaching CNY714.80 from an issue price of CNY114.28.