Select Language:

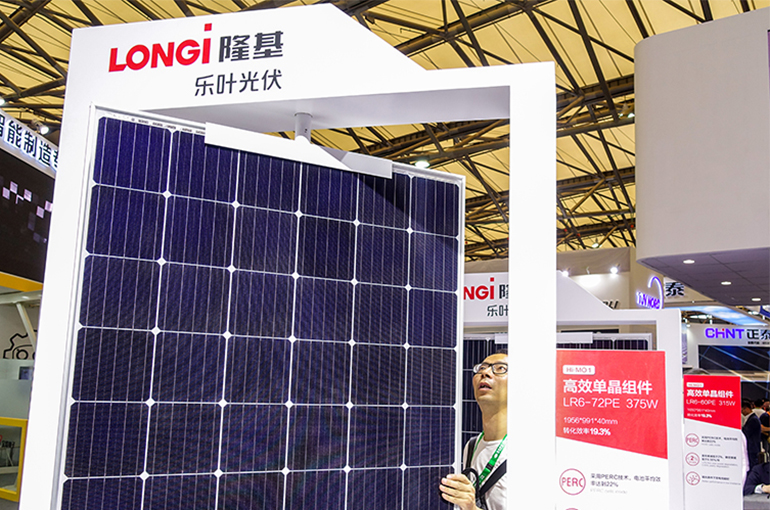

In the first half of this year, major solar companies including Longi Green Energy, Tongwei, Trina Solar, JA Solar Technology, and TCL Zhonghuan Renewable Energy collectively reported a loss of approximately 17.3 billion yuan (about 2.4 billion USD). This setback was driven by a sharp decline in prices caused by a significant imbalance between supply and demand.

Longi’s financial results showed a 51% reduction in net loss, totaling 2.6 billion yuan (around 360 million USD) for the six months ending June 30, making it the only one among these giants to see an improvement in its situation, according to a recent financial report. Conversely, Tongwei’s losses increased by 59%, reaching 5 billion yuan. Trina Solar shifted into the red with a net loss of 2.9 billion yuan, reversing a previous profit of 526 million yuan (approximately 74 million USD). This was the company’s first quarterly loss since its IPO in 2020. JA Solar’s losses soared by 195% to 2.6 billion yuan, while TCL Zhonghuan’s losses grew 38% to 4.2 billion yuan, based on earnings reports issued simultaneously.

The broad losses are attributed to an extreme imbalance between global supply and demand, which has led to sharp price drops across the entire photovoltaic supply chain. Production growth of solar cells and modules slowed to below 15% in the first half of the year, while output of polysilicon and wafers declined, according to data from the industry association. Prices for key products in each segment plummeted around 81% to 90% from their peak levels since 2020.

More than 40 companies have exited the market, filed for bankruptcy, or been involved in mergers and acquisitions since the beginning of last year, the association’s incomplete statistics reveal. Additionally, as the renewable energy sector expands rapidly, some traditional solar markets are facing challenges such as grid capacity issues, expiration of subsidies, and low electricity prices. Policy uncertainties and regulatory changes have also become major concerns for industry players.

For instance, JA Solar mentioned potential reforms in renewable energy feed-in tariffs as a source of uncertainty, while Trina Solar warned that if supply-demand imbalances persist in the second half of the year, it could lead to ongoing volatility or further declines in operational performance.

Despite these struggles, some companies benefited from market trends. Hefei-based Sungrow Power Supply saw its first-half net profit jump by 56%, reaching 7.7 billion yuan, according to its recent financial report. Similarly, Canadian Solar reported a 5% increase in profit for the period, totaling 3.2 billion yuan.

In an effort to address ongoing issues, Chinese regulators from the Ministry of Industry and Information Technology and other agencies held fresh meetings with solar companies on August 19. The goal was to reverse unhealthy competition practices that have damaged profitability. Insiders indicated that concrete measures might be finalized within days, focusing on tightening regulations, scrutinizing new investment projects, and phasing out outdated capacity. Discussions also included strategies to curb chaotic price competition, such as implementing stricter price oversight and cracking down on below-cost sales and misleading marketing practices.