Select Language:

Companies’ supply chain capabilities are becoming their key competitive advantage in the face of rising costs for components and parts driven by skyrocketing memory prices, according to the CEO of a major personal computer manufacturer.

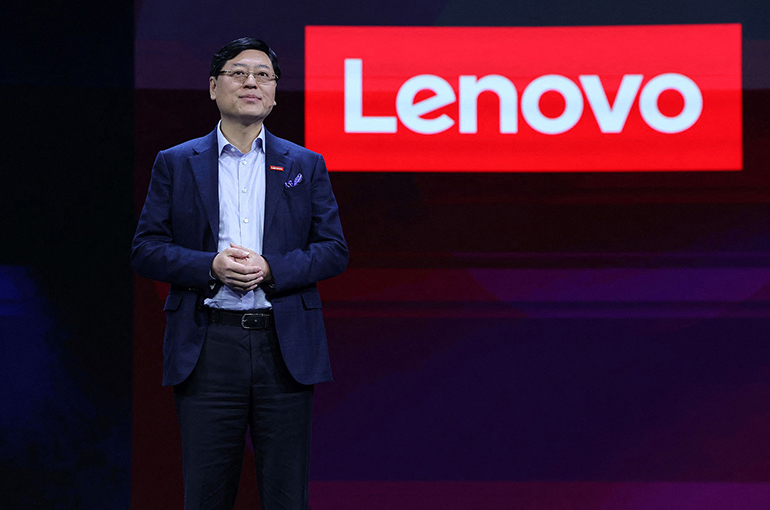

“It all comes down to who can secure more supplies at lower costs,” stated Yang Yuanqing during a recent earnings call. He emphasized that the company’s scale, diverse supply network, and strong long-term relationships with suppliers are establishing a protective moat amidst climbing raw material prices, Yang explained.

While cloud service providers have a significant demand for memory products, the company’s broad business scope—covering PCs, smartphones, and servers—means it commands a procurement scale comparable to that of individual cloud providers. This size advantage affords it greater negotiation power, enabling the company to secure supplies more efficiently and at reduced costs, Yang noted.

The company’s “global resources, local delivery” approach has helped establish a diversified supply chain that includes both international vendors and numerous Chinese partners. This flexible setup allows for optimal resource allocation and mitigates risks linked to reliance on a single supplier, Yang added.

Furthermore, maintaining close, long-term relationships based on mutual trust with upstream manufacturers ensures priority access to supplies during tight inventories. The company’s transactions with key suppliers are valued in the billions to tens of billions of U.S. dollars, he revealed.

For example, business dealings with U.S. chip giant Nvidia have quadrupled over the past three to four years, with plans to expand this partnership even further in the near future, Yang stated.

Following last April’s announcement of reciprocal tariffs on imports from all countries, most OEMs adopted a more cautious approach to ordering, according to Lenovo’s CFO Zheng Xiaoming. The company accurately forecasted future demand and increased stockpiles proactively. As a result, rising memory prices later boosted inventory valuations in the company’s favor, Zheng explained.

While some segments of the AI investment space are overheated, the overall trajectory of AI development remains strong and sustainable, Yang asserted. AI, he said, relies on large data sets, robust computing power, and sophisticated models to create intelligent capabilities.

The most significant gains from AI are expected to occur at the individual and corporate levels, where private data will be used to develop personalized and business intelligence. This concept aligns with the company’s “hybrid AI” strategy. Yang believes this trend is irreversible and will continue to drive demand for smarter devices and AI infrastructure, fueling further growth in the market.

In its latest financial report, the company revealed a 36% increase in net profit to approximately $594 million USD for the quarter ending December 31, compared to the previous year. Revenue grew by 18%, reaching around $22.8 billion USD.

Artificial intelligence has become a pivotal driver of growth, with related revenue soaring 72% and accounting for nearly a third of the company’s total income. Revenue from AI-enabled PCs saw strong double-digit growth, AI smartphones experienced triple-digit increases, and AI server sales also climbed significantly, according to the report.