Select Language:

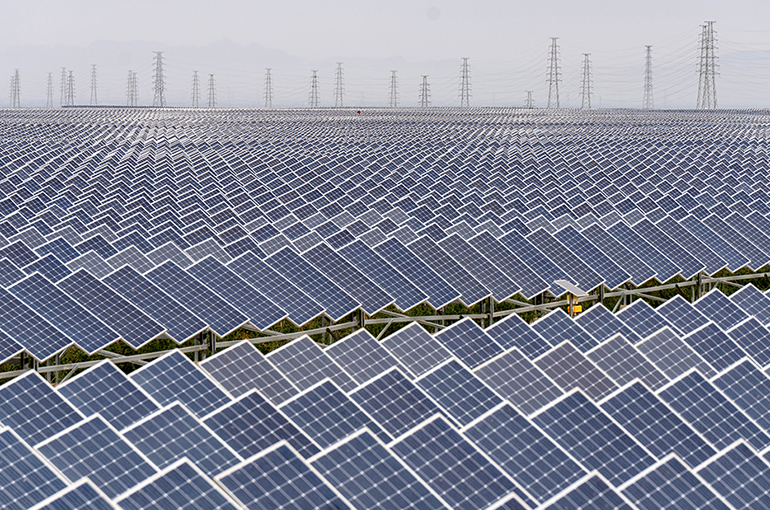

Oct. 29 — A Chinese polysilicon manufacturer has turned a profit in the third quarter, following the implementation of new policies in the photovoltaic industry aimed at reducing intense competition, which led to a recovery in prices.

Net income reached CNY73.5 million (USD10.4 million) for the three months ending September 30, reversing a loss of CNY429 million (USD60.4 million) from the same period last year, the company announced on Oct. 27. Revenue increased by 25% to CNY1.8 billion (USD250 million).

The company’s shares surged 7.1%, closing at CNY30.45 (USD4.29) in Shanghai today, following a 3% gain yesterday and on Oct. 27. Its American-listed stock in New York decreased 1% to USD29.43 yesterday, after a 14.1% rise on Oct. 27.

The company pointed out that under the influence of policies against overcapacity, the polysilicon market experienced a price rebound in the third quarter. It adjusted its production and sales strategies swiftly to market conditions, successfully benefiting from the price increase, boosting revenue, and returning to profitability.

In the first half, polysilicon prices fell sharply due to oversupply, creating significant pressure on manufacturers. The company reported a net loss of CNY1.1 billion during this period, with revenue dropping 68% to CNY1.5 billion, according to its semiannual financial results.

In August, six government agencies, including the National Development and Reform Commission and the State Administration for Market Regulation, held a joint meeting with industry players to promote order regulation in the photovoltaic sector. They emphasized the importance of capacity control, curb illegal competition, and banned the sale of products at prices below cost.

Supported by regulatory efforts, polysilicon prices began to recover. The average selling price rose nearly 37% in the third quarter, reaching CNY41.49 per kilogram from CNY30.33 in the second quarter, according to the company.

The company has actively adjusted its production in line with regulatory requirements. During the first three quarters of the year, it reduced polysilicon output by 52%, to 81,471 tons, compared to the previous year.

Looking ahead to the fourth quarter, the company estimates production will stay between 39,500 and 42,500 tons.

Meanwhile, Tongwei Group, China’s largest polysilicon producer, did not become profitable in the third quarter. However, its net loss shrank by 63% to CNY315 million (USD44.4 million) from the same period last year, while revenue declined slightly by 1.6% to CNY24.1 billion (USD3.4 billion).