Select Language:

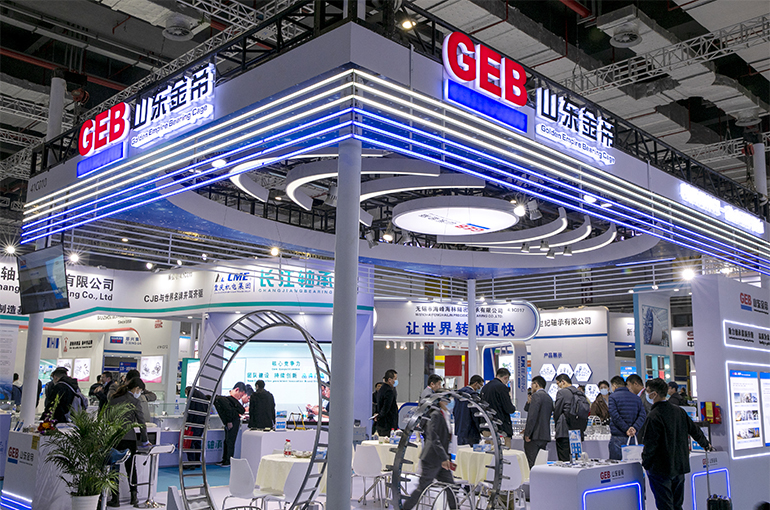

Golden Empire Precision Machinery Technology announced plans for a significant investment of CNY1.1 billion (approximately USD154 million) to establish two new factories focused on producing essential precision components for the emerging energy vehicle sector, along with expanding its manufacturing plant in Serbia.

The company will invest CNY300 million (around USD42 million) to develop a new facility in Ma’anshan, Anhui Province, and an additional CNY530 million (about USD74 million) in a second plant situated in Liaocheng, Shandong Province. Both facilities are designated to manufacture high-precision parts aimed at the new energy sector.

These factories will specialize in producing stators and rotors for electric drive engines, wind turbine components, vital parts for embodied AI robots, and motors and structural elements for low-altitude aerial vehicles. Construction for the Ma’anshan plant is scheduled to commence in October with ramp-up expected by September 2027. The Liaocheng plant will start construction in August next year and should be operational by July 2028.

On the same day, the company revealed a separate plan to inject EUR30 million (around USD35 million) into its Serbian subsidiary to better serve international clients in the new energy market and to strengthen its global footprint. This investment raises the total committed capital in the Serbian project from CNY150 million to CNY400 million.

The firm indicated its intention to continue investing in the Serbian operation based on market trends and sales results, with a long-term goal of increasing total investment to approximately EUR110 million (about USD128 million).

Last December, the company disclosed its plans to establish a manufacturing facility in Serbia, focusing on R&D, manufacturing, and sales of components used in electric drive systems for new energy vehicles. Further details about the project were not provided.

Electric drive systems are among the company’s core offerings within its automotive precision parts division, according to its financial results for the first half of the year. The company reports key European clients including Tata Motors, Valeo, Brose, and ZF.

Shares of the company ended the day 1.4% lower at CNY26.70 (around USD3.73) each, while the broader Shanghai stock market saw a modest gain of 0.4%.